All Categories

Featured

Table of Contents

On the other hand, if a client needs to offer for an unique demands child who might not have the ability to manage their own money, a trust fund can be included as a beneficiary, allowing the trustee to handle the circulations. The kind of beneficiary an annuity owner selects influences what the beneficiary can do with their inherited annuity and just how the earnings will certainly be tired.

Several agreements permit a partner to determine what to do with the annuity after the owner passes away. A spouse can transform the annuity agreement right into their name, presuming all regulations and rights to the initial agreement and delaying prompt tax obligation repercussions (Income protection annuities). They can accumulate all staying repayments and any type of fatality benefits and pick beneficiaries

When a spouse ends up being the annuitant, the spouse takes over the stream of settlements. Joint and survivor annuities additionally enable a named beneficiary to take over the agreement in a stream of settlements, instead than a swelling amount.

A non-spouse can just access the assigned funds from the annuity proprietor's first arrangement. In estate planning, a "non-designated beneficiary" refers to a non-person entity that can still be called a recipient. These include counts on, charities and various other companies. Annuity owners can choose to designate a count on as their beneficiary.

What should I know before buying an Retirement Annuities?

These distinctions mark which beneficiary will get the whole fatality advantage. If the annuity owner or annuitant passes away and the key recipient is still to life, the primary recipient gets the survivor benefit. Nevertheless, if the main recipient predeceases the annuity owner or annuitant, the fatality benefit will certainly most likely to the contingent annuitant when the proprietor or annuitant passes away.

The proprietor can alter recipients any time, as long as the contract does not call for an irreversible beneficiary to be called. According to skilled factor, Aamir M. Chalisa, "it is very important to recognize the value of designating a recipient, as picking the incorrect beneficiary can have major effects. A number of our customers select to call their underage children as recipients, commonly as the main beneficiaries in the absence of a partner.

Proprietors who are wed must not assume their annuity immediately passes to their spouse. Commonly, they go through probate. Our short test provides clearness on whether an annuity is a clever selection for your retirement profile. When choosing a beneficiary, think about elements such as your relationship with the individual, their age and how inheriting your annuity may impact their economic scenario.

The beneficiary's connection to the annuitant normally identifies the regulations they comply with. For instance, a spousal beneficiary has more choices for handling an inherited annuity and is dealt with even more leniently with taxation than a non-spouse beneficiary, such as a kid or other relative. Senior annuities. Expect the proprietor does determine to call a youngster or grandchild as a recipient to their annuity

What should I look for in an Long-term Care Annuities plan?

In estate preparation, a per stirpes classification defines that, ought to your recipient die before you do, the recipient's offspring (kids, grandchildren, et cetera) will receive the survivor benefit. Get in touch with an annuity professional. After you have actually picked and called your beneficiary or beneficiaries, you should remain to assess your options a minimum of once a year.

Maintaining your classifications approximately day can make certain that your annuity will be managed according to your dreams should you die suddenly. Besides an annual review, significant life occasions can motivate annuity proprietors to reevaluate at their recipient selections. "Somebody may intend to update the recipient classification on their annuity if their life circumstances change, such as getting wedded or divorced, having youngsters, or experiencing a death in the family," Mark Stewart, CPA at Detailed Organization, told To transform your beneficiary designation, you need to connect to the broker or agent who handles your agreement or the annuity company itself.

Why is an Tax-efficient Annuities important for long-term income?

Similar to any financial product, looking for the assistance of an economic expert can be helpful. A monetary coordinator can direct you with annuity monitoring procedures, including the methods for updating your contract's beneficiary. If no beneficiary is called, the payment of an annuity's survivor benefit mosts likely to the estate of the annuity owner.

To make Wealthtender free for visitors, we make cash from advertisers, including economic professionals and firms that pay to be included. This develops a dispute of interest when we prefer their promotion over others. Wealthtender is not a customer of these economic services companies.

As a writer, it is among the most effective praises you can offer me. And though I actually value any one of you investing several of your hectic days reviewing what I create, slapping for my short article, and/or leaving appreciation in a comment, asking me to cover a topic for you really makes my day.

It's you claiming you trust me to cover a topic that is necessary for you, which you're confident I would certainly do so better than what you can currently locate on the internet. Pretty spirituous things, and a duty I don't take most likely. If I'm not knowledgeable about the subject, I research it on the internet and/or with get in touches with that know even more regarding it than I do.

Who has the best customer service for Income Protection Annuities?

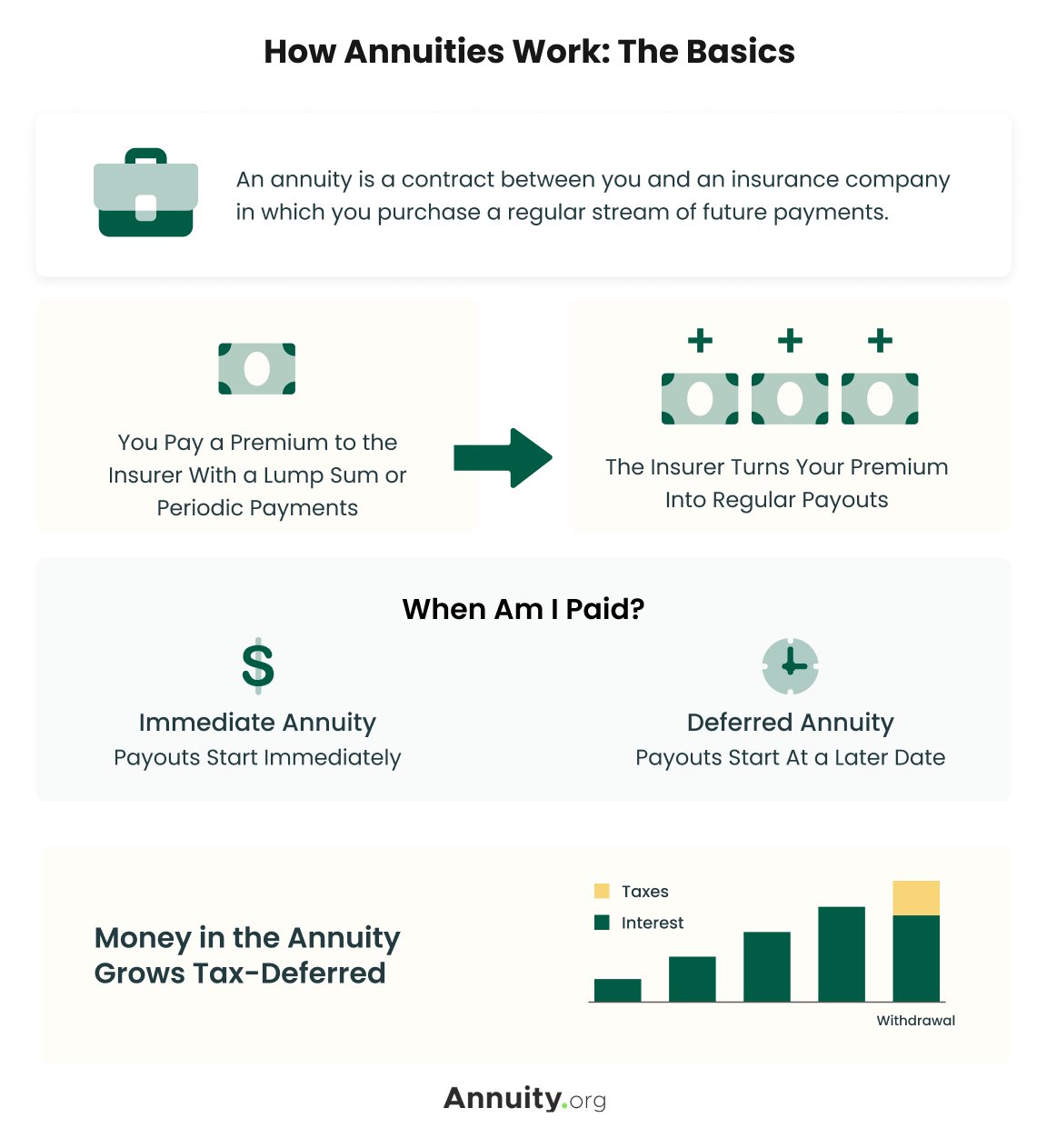

In my good friend's case, she was assuming it would be an insurance coverage of kinds if she ever before enters into nursing home care. Can you cover annuities in a post?" Are annuities a legitimate suggestion, an intelligent step to protect surefire income for life? Or are they a dishonest consultant's means of fleecing unwary clients by convincing them to move properties from their portfolio right into a complicated insurance item pestered by too much fees? In the most basic terms, an annuity is an insurance item (that just qualified representatives may sell) that guarantees you regular monthly settlements.

Exactly how high is the surrender cost, and for how long does it use? This normally puts on variable annuities. The more bikers you tack on, and the much less danger you agree to take, the lower the settlements you ought to anticipate to obtain for a given costs. The insurance company isn't doing this to take a loss (however, a bit like a gambling establishment, they're willing to lose on some customers, as long as they even more than make up for it in greater revenues on others).

Where can I buy affordable Secure Annuities?

Annuities picked properly are the appropriate choice for some people in some scenarios., and then number out if any annuity option uses sufficient benefits to warrant the prices. I used the calculator on 5/26/2022 to see what an instant annuity might payment for a single premium of $100,000 when the insured and spouse are both 60 and live in Maryland.

Table of Contents

Latest Posts

Exploring the Basics of Retirement Options Everything You Need to Know About Fixed Annuity Vs Equity-linked Variable Annuity Defining Annuities Variable Vs Fixed Advantages and Disadvantages of Differ

Exploring Fixed Vs Variable Annuities A Comprehensive Guide to What Is Variable Annuity Vs Fixed Annuity Defining Fixed Income Annuity Vs Variable Growth Annuity Pros and Cons of Fixed Index Annuity V

Highlighting the Key Features of Long-Term Investments A Comprehensive Guide to Fixed Income Annuity Vs Variable Growth Annuity What Is the Best Retirement Option? Benefits of Choosing the Right Finan

More

Latest Posts