All Categories

Featured

Table of Contents

For those going to take a little bit much more threat, variable annuities supply extra possibilities to grow your retirement properties and possibly increase your retirement revenue. Variable annuities provide a variety of investment choices looked after by professional money managers. As an outcome, investors have a lot more versatility, and can also move possessions from one alternative to an additional without paying taxes on any financial investment gains.

* A prompt annuity will certainly not have a buildup phase. Variable annuities provided by Protective Life Insurance Coverage Business (PLICO) Nashville, TN, in all states other than New York and in New York by Protective Life & Annuity Insurance Policy Company (PLAIC), Birmingham, AL.

Financiers need to carefully think about the investment goals, dangers, fees and costs of a variable annuity and the underlying financial investment options before spending. This and other info is included in the syllabus for a variable annuity and its underlying financial investment choices. Prospectuses may be gotten by contacting PLICO at 800.265.1545. An indexed annuity is not a financial investment in an index, is not a protection or securities market financial investment and does not take part in any type of supply or equity investments.

What's the difference between life insurance policy and annuities? It's an usual concern. If you question what it takes to safeguard a monetary future on your own and those you enjoy, it might be one you find yourself asking. Which's a very excellent thing. The lower line: life insurance coverage can assist supply your liked ones with the financial peace of mind they are worthy of if you were to die.

Why is an Annuity Withdrawal Options important for long-term income?

Both must be considered as part of a long-term economic strategy. Both share some resemblances, the general purpose of each is extremely various. Allow's take a glimpse. When contrasting life insurance coverage and annuities, the biggest distinction is that life insurance coverage is designed to aid safeguard versus an economic loss for others after your fatality.

If you desire to find out also a lot more life insurance policy, checked out up on the specifics of exactly how life insurance policy works. Think of an annuity as a device that can assist satisfy your retired life requirements. The primary purpose of annuities is to create income for you, and this can be performed in a few different ways.

What is the most popular Long-term Care Annuities plan in 2024?

There are many potential advantages of annuities. Some consist of: The capability to expand account worth on a tax-deferred basis The capacity for a future earnings stream that can't be outlived The possibility of a round figure advantage that can be paid to a surviving partner You can get an annuity by giving your insurance provider either a single round figure or paying gradually.

:max_bytes(150000):strip_icc()/pvifa.asp_FINAL-b83a6fb569444fc28d9d478c1335ce00.png)

People normally get annuities to have a retirement income or to develop savings for one more function. You can get an annuity from a qualified life insurance policy representative, insurance company, financial planner, or broker. You need to talk with an economic adviser concerning your demands and goals before you acquire an annuity.

Are Annuity Riders a safe investment?

The difference between the 2 is when annuity payments begin. You don't have to pay tax obligations on your incomes, or contributions if your annuity is a private retired life account (IRA), up until you take out the earnings.

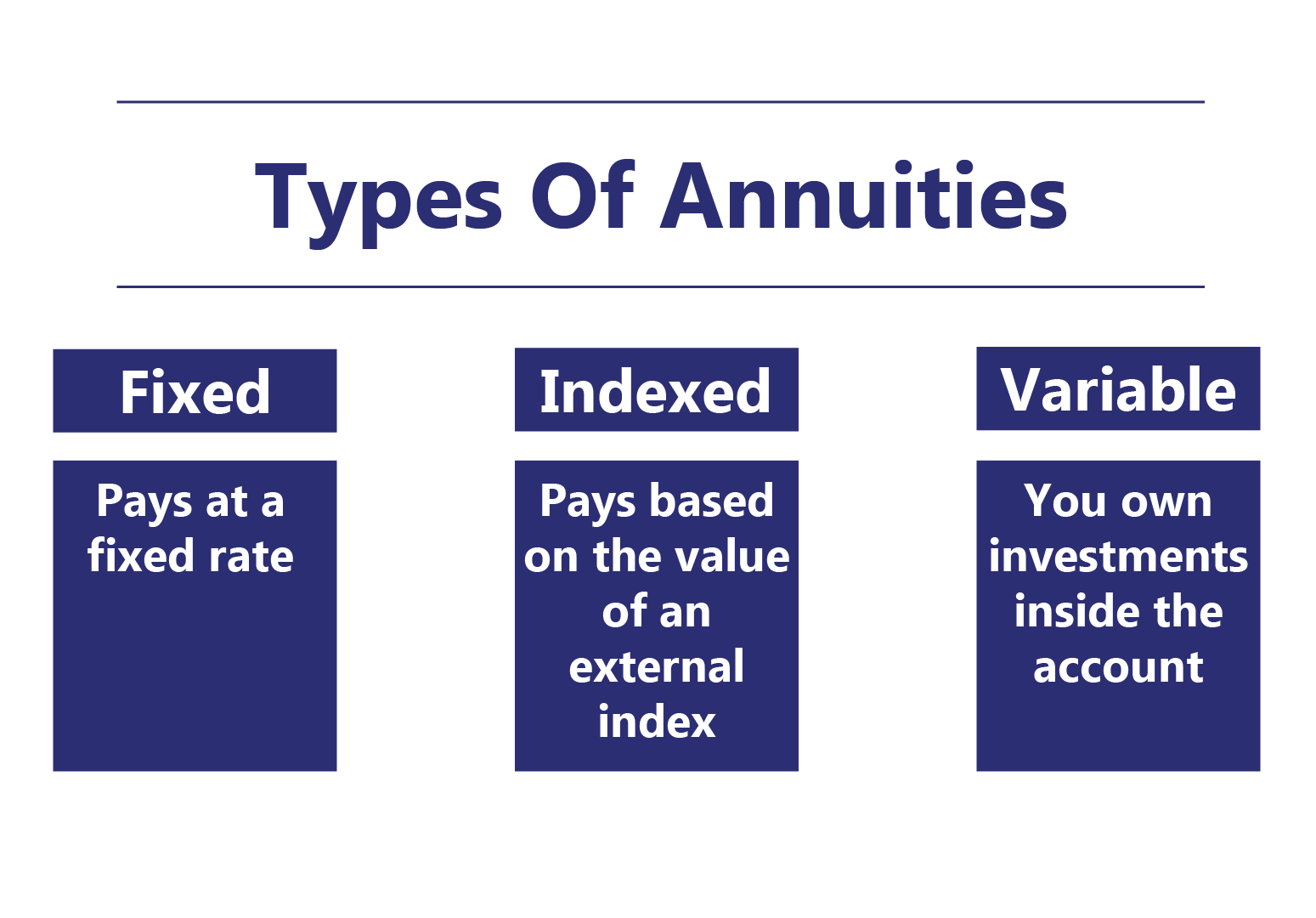

Deferred and immediate annuities supply numerous options you can pick from. The options provide various levels of prospective danger and return: are guaranteed to make a minimal passion price.

Variable annuities are greater threat due to the fact that there's a chance you can lose some or all of your money. Set annuities aren't as dangerous as variable annuities because the financial investment danger is with the insurance coverage business, not you.

Set annuities guarantee a minimum interest rate, typically between 1% and 3%. The business could pay a higher rate of interest price than the guaranteed passion price.

How much does an Annuity Income pay annually?

Index-linked annuities show gains or losses based on returns in indexes. Index-linked annuities are extra intricate than taken care of postponed annuities (Income protection annuities).

Each counts on the index term, which is when the company determines the rate of interest and credit ratings it to your annuity. The figures out just how much of the rise in the index will certainly be used to determine the index-linked rate of interest. Various other essential features of indexed annuities consist of: Some annuities cover the index-linked rates of interest.

Not all annuities have a floor. All dealt with annuities have a minimum guaranteed worth.

How can an Annuity Payout Options help me with estate planning?

The index-linked rate of interest is included to your initial costs quantity however doesn't compound throughout the term. Other annuities pay substance interest throughout a term. Compound interest is passion made on the cash you saved and the passion you gain. This suggests that rate of interest already credited likewise makes interest. In either instance, the interest earned in one term is usually worsened in the following.

This portion could be made use of instead of or in addition to a participation price. If you get all your cash before completion of the term, some annuities will not attribute the index-linked interest. Some annuities may credit just component of the passion. The percentage vested usually increases as the term nears completion and is always 100% at the end of the term.

Immediate Annuities

This is because you birth the financial investment threat rather than the insurance policy business. Your agent or financial adviser can assist you decide whether a variable annuity is best for you. The Stocks and Exchange Commission categorizes variable annuities as safeties because the performance is stemmed from supplies, bonds, and various other investments.

An annuity contract has 2 stages: a buildup stage and a payout phase. You have numerous alternatives on just how you add to an annuity, depending on the annuity you get: enable you to pick the time and amount of the payment.

Table of Contents

Latest Posts

Exploring the Basics of Retirement Options Everything You Need to Know About Fixed Annuity Vs Equity-linked Variable Annuity Defining Annuities Variable Vs Fixed Advantages and Disadvantages of Differ

Exploring Fixed Vs Variable Annuities A Comprehensive Guide to What Is Variable Annuity Vs Fixed Annuity Defining Fixed Income Annuity Vs Variable Growth Annuity Pros and Cons of Fixed Index Annuity V

Highlighting the Key Features of Long-Term Investments A Comprehensive Guide to Fixed Income Annuity Vs Variable Growth Annuity What Is the Best Retirement Option? Benefits of Choosing the Right Finan

More

Latest Posts